𝐓𝐨 𝐜𝐮𝐭 𝐨𝐫 𝐧𝐨𝐭 𝐭𝐨 𝐜𝐮𝐭...

With odds of an interest cut in September running at 50%, let's try to understand the nuance behind the decision.

In my previous post, I discussed about the depreciation of $USDOLLAR and discussed factors causing this and how to deal with it.

This is a RED year

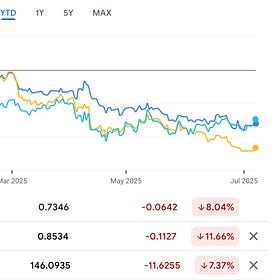

While the stock market is at an all time high and the $SPX500 (SPX500 Index (Non Expiry)) is up 6.5%, the $USDOLLAR (US Dollar Index (Non Expiry)) has depreciated sharply against most major currencies in the world.

Now let's understand the role of the US Federal Reserve in this.

Jerome Powell seems determined to bring inflation down to the arbitrary target of 2% and holding steady with the interest rates, despite pressure from Donald Trump to lower the rates. As of now, inflation has been falling gracefully from 3% in January to 2.4% in June. That should be good news, but is it?

Depreciation of currency should lead to increase in prices of goods. That is literally the definition of inflation. And yet, despite the USD depreciating by 8%, we've seen rate of inflation gradually coming down in the US so far in 2025.

Inflation is affected by demand and supply of goods. So if it the cost to produce and transport goods is falling, then prices of goods might fall. This may be one reason for the lower inflation.

But the other more worrying reason may be that the consumer demand is dropping even faster than the value of the USD 0.00%↑ OLLAR . This could be caused by rising fear of recession among consumers. There have been a slew of publicized layoffs in the tech industry, and it is reasonable to expect that other industries are also facing loss of jobs.

We have seen a drop in retail spending in May and June, along with a drop in discretionary spending on things like restaurants and entertainment. The amount of household debt has gone up, although credit card balances have dropped, further suggesting that people are cutting down on discretionary spending. Other indicators suggest contraction in services and manufacturing due to reduced demand.

If things were to continue like this, it could lead to a deflationary scenario. The Fed would like to avoid this at all costs, because that is downward spiral much more dangerous than inflation. If demand drops so much that prices start to fall, this would lead to an much more jobs being lost, which would further hurt demand and so on.

The odds of Fed cutting rates were very high at the start of the year, but they have been falling amid depreciating USD. Lowering interest rates would flood more USD in the market and lead to further depreciation of the currency. This could lead to a spike in inflation.

However, if consumer demands falls too much the US Fed may be forced to lower interest rates. Historically, consumer demand has been very resilient in the US, but there is still a lag in how quickly demand picks up after a drop in the interest rates. Meanwhile, this would lead to further depreciation of the $USDOLLAR.

Now you should understand the nuance in the decision regarding lowering of interest rates and why the odds of an interest rate drop in September stand smack in the middle at 50%.

--

I don't claim to be an expert in economics, but I am a student of it. I try to understand complicated concepts by breaking them down into simple words, until they appeal to my common sense. I hope my posts are useful to you. My understanding is ever-evolving. Please feel free to share your opinions and counter-opinions with me, I'd be grateful for it.