This is a RED year

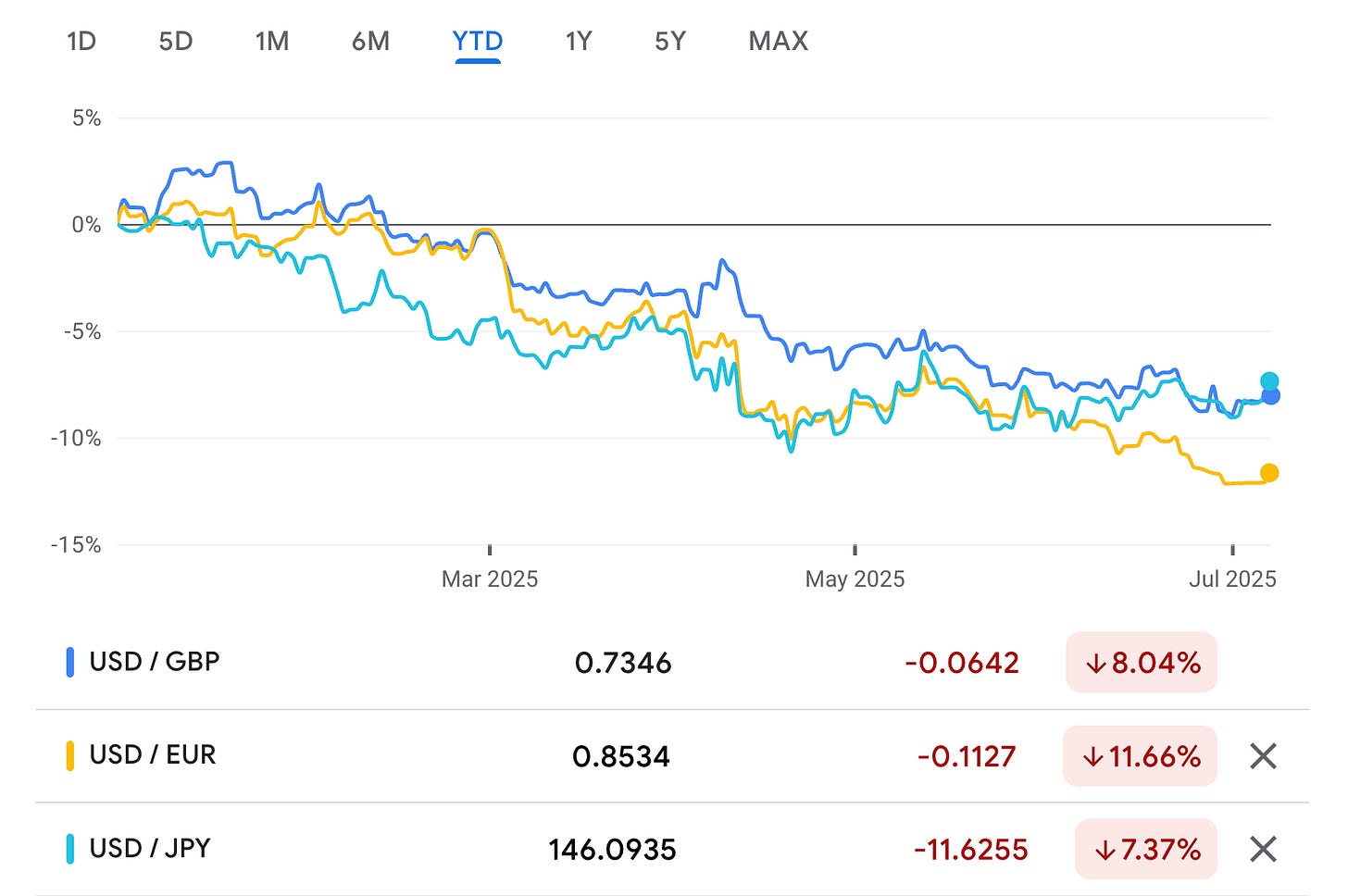

While the stock market is at an all time high and the S&P500 is up 6.5%, the USDOLLAR has depreciated sharply against most major currencies in the world.

While the stock market is at an all time high and the $SPX500 (SPX500 Index (Non Expiry)) is up 6.5%, the $USDOLLAR (US Dollar Index (Non Expiry)) has depreciated sharply against most major currencies in the world.

$USDEUR is down 12%

$USDGBP is down 8.2%

$USDJPY (USD/JPY) is down 8%

For Europeans investing in the US stock markets in EUR, your investments have lost 12% due to currency depreciation. If your portfolio has gained less than that, then you are in the red. This includes me. My portfolio has gained around 10% so far this year, which beats the index, however in EUR my portfolio currently stands at a loss of roughly 2% YTD.

Just FYI, for tax filing, the price of your US stock is considered at the current value of the stock in EUR when buying and selling. So even if the value of my portfolio in USD is going up, I am not making a profit in EUR and won't be paying taxes.

But let's dig a bit deeper. Why is the USD depreciating?

The supply and demand dynamics that affect the price of USD are diverse and too complex to cover here fully.

The USD is the preferred currency for international trade, and strength of the world economy and consumer demand around the world drives the demand of USD. Countries are forced to hold reserves of USD in the form of US government bonds which are regarded as the safest investments. The strength of the American economy and confidence in American companies to retain leadership in innovation also drives demands foreign investments in the US, further boosting demand for USD.

However, political instability and policy uncertainty in the US drive investors away. Worries of economic slowdown and trade disruptions caused by wars and tariffs lead to drop in consumer demand. The realization that the US government may be in a debt death spiral and the lack of political will to address the growing debt leads to a loss of confidence in the safety of US treasury bonds.

The USD peaked in January after the inauguration of Donald Trump. He promised to fix the budget deficit by reducing waste and boosting economic growth. This was music to the ears for those who were concerned with the large amount of debt on the US. It is becoming largely evident that the DOGE failed to cut much waste. Tariffs and how they were executed have cast doubts and created fear of global economic slowdown. The OBBB also appears to be a disappointment as the tax cuts are minimal for the vast majority of middle class and spending cuts are inadequate, while the debt limit has been further raised.

A cheaper USD may in fact be good for the US as it would boost competitiveness of exporters in the US. However US has a large export deficit. Even if incentives are in place, it will take a long time for companies to move production from other countries to the US. In the meanwhile, tariffs and USD depreciation will be a double whammy on inflation and will lead to a drop in consumption.

This has all been priced-in in the price of the $USDOLLAR (US Dollar Index (Non Expiry)).

Now, all that said, there are still reasons to continue to invest in the US. They are still a leader in innovation. The government has a laser focus on driving innovation in AI which will create a strong disruption in the market. Meanwhile, as the value of the EUR appreciates, exports from European companies become less competitive, making these less attractive for investment. While Trump's actions are unpredictable, it is highly likely that he will eventually ̶c̶h̶i̶c̶k̶e̶n̶ ̶o̶u̶t̶ negotiate reasonable trade deals.

Some damage has already been done though and the impact of this may be visible in earnings reports in the coming quarters. In fact some of this is already priced-in in the valuation of most companies. I expect interesting investment opportunities to arise in the coming months. Moreover, by continuing to add funds and dollar cost average, we are guarding ourselves against currency fluctuations too. I had added around 15% funds in April when the $USDEUR had already dropped from 0.96 to 0.88.

As the $USDEUR stands today at 0.85, I will be adding roughly 10% funds to my portfolio tomorrow. As usual, copiers do not have to match funds, their portfolios will automatically rebalance to match mine. However, I strongly recommend copiers to regularly add funds to their copies and dollar cost average. This way your copies may even earn more than my portfolio.

Thank you for reading. I look forward to your comments, opinions and questions.