Why don't people want to invest money in stocks?

Many young people do not want to invest money in stock markets. In this post, I address most of their excuses and try to help clear some common misconceptions.

Many young people do not want to invest money in stock markets. In this post, I address most of their excuses and try to help clear some common misconceptions.

Too risky

Every investment carries risk and there is no reward without risk. But stock investment is misconceived to be very risky. Gold and real estate are assumed to be relatively low risk.

If you check the price history of $GOLD, you will see that it reached a peak in 2011 and it took 9 years for it to breach that price again. Gold does not have a utility and the trends in Gold prices are driven by market sentiments. The trends in the past decades have largely been driven by fear after recessions or pandemic. In comparison, the $SPX500 has been much more stable and achieved significantly higher growth.

Real estate is a much more risky investment. Selling a real estate in times of need can be very difficult due to low liquidity of the market. High closing costs such as commissions, transfer taxes and capital gains taxes eat into your profit margin. There is also considerable risk of damages that need expensive repairs.

In fact, real estate should be the last place to invest money after maxing out your tax saving pension plans and investing money in stock markets.

Too little money to invest

Some people think they need to start with large amount of investment for it to be worth the effort. At the time of this writing, popular stocks like TSLA 0.00%↑ is trading roughly at $240 at the time of this writing and META 0.00%↑ is trading at ~$580. Most people do not have spare cash to buy a single stock, and even if they do it is not wise to put so much in a single stock.

Perhaps they don’t know that they can buy fractional shares on most trading platforms. This means they can start with $500 and split that into 10 stocks and buy $50 worth of each stock. By adding $200 every month, they can quickly grow their portfolios.

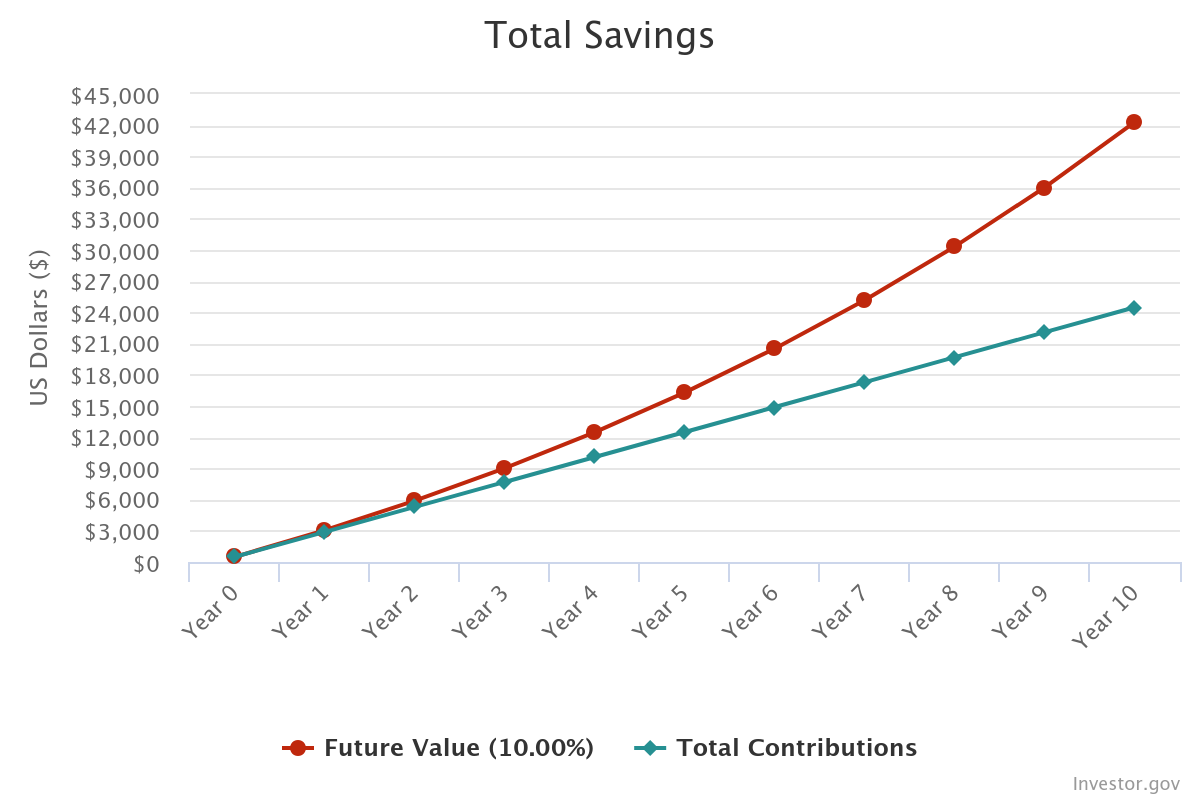

I used this compound interest calculator to generate this image which shows the growth of such a portfolio, with a fairly reasonable projection of 10% growth every year. In 10 years, you would have invested $24500 and earned a profit of $17822.52. Assuming you start investing at 25 and continue investing like this for the next 40 years until you retire, you will have over $1.29M in your portfolio from total contribution of less than $100k. You don’t believe me? Do the math for yourself using this calculator. No wonder Einstein said,

“Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn't, pays it”.

Over this time, your capacity to invest will most likely increase and additional contributions will only help this math look even better.

Too complicated

Many believe that stock investment is really complicated and you need to spend a lot of time learning. Even after that, it takes a lot of your time and energy and causes a lot of stress.

The fact is that the most reliable strategy to make money in stock market is also the most easy to execute.

If you don’t want to spend any brain cycles, you can simply Dollar Cost Average on one of the ETFs tracking an index such as $SPX500. The annualized return of $SPX500 over the last 50 years is roughly 10% which beats the inflation and the interest rate.

In fact, you can even beat the index with only a little bit more effort using my Common Sense Investing strategy.

In short, find 10 to 15 companies from around your personal experience and area of expertise, which are performing well and diversify your money among these companies. Start with a small amount of money and invest in these positions regularly, especially buying the dips. Do not invest more than 10% in any single company at any given time. Regularly monitor the performance of these companies and review whether they continue to be out-performers.

Most retail traders fail to beat the indexes and even lose money in the stock market, primarily because they trade too much. The simple strategy I explained above can be executed with minimal effort. You don’t need to be glued to your screen 24 hours and only need to execute less than 5 trades every week.

I get it, but still… not for me.

Even when you know it’s good for you and it’s really easy to do, sometimes you just can’t get yourself to do it. I know how you feel. I used to feel the same way about exercising. I understand compound interest in finance, but for many years I ignored the compounding effect that simple exercise and dietary regulation can have on your health. Over the years, I did try to get fit. But most often I did too much exercise without focussing on nutrition, in process hurting myself and losing motivation.

After a significant health crisis, I have embraced a simple strategy. I started small, with just intermittent fasting and simple dietary changes along with 6k steps and 20 minutes of zone 2 workout every day. This is sustainable for me and I can easily fit this in my schedule. I didn’t see results for the first few weeks, but very quickly I started losing 1 kg of weight every 2 to 3 weeks and have since lost 8 kgs. This has improved my capacity to workout and I am easily exceeding my targets.

You should think of investment in the same way as exercising. Maybe you tried in the past and lost money due to taking too much risk. You should start a fresh with this Common Sense Investing strategy. Start slowly and stay motivated when you don’t see any significant results in the beginning. Add funds regularly and make this a habit. With time your confidence will grow along with your capacity to invest more money and you can increase the amount of funds you add. In time you will start seeing the results.

This journey may not be as easy as I have described. It does take a lot of discipline and courage to stick to the plan, especially when the market gets volatile. But it is also not as difficult as most people think, or make it look like.

If you don’t have the time to execute this strategy yourself, or you don’t trust yourself to have the discipline it takes, you can consider copying me on eToro. eToro gives you the opportunity to invest money by copying other experience investors in the same way you’d invest money with a professional account manager. The big advantage is that you get much more control and much better transparency on eToro. You are free to ask questions to your investor and you can start and stop copying whenever you want. Best of all, you also do not pay any fees for copying.

I practice the strategy I have described above. I maintain a high standard of transparency, explaining my trade decisions and being open to questions and opinions. Over the past 5 years I have gained over 1500 copiers and manage over $2.5M in Assets under Copy (AUC). I welcome you to read my posts and review my portfolio here. If youa re not yet on eToro, consider using this referral link to join.