My Common Sense Investing journey

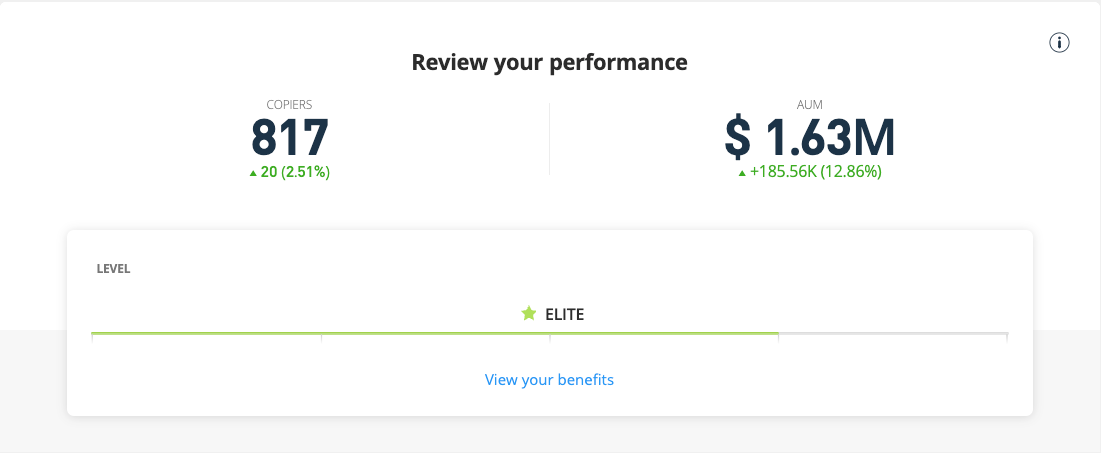

I am an “Elite Popular Investor” on eToro and I manage funds over $1.5M from over 800 copiers, and in this post I want to share with you the common sense investment strategy that has been giving me and my copiers consistent results over the last 5 years.

If you are not familiar with eToro, it is a social stock trading platform where investors can copy the investments of other experienced investors. The feed on the platform is a great resource to find good investors to copy and learn from. eToro has other great advantages over other online brokers such as zero transaction fees and a great user experience. If you haven’t joined eToro yet, consider using my referral link to join.

I regularly write educational posts on eToro. I want to start writing on Substack, to provide a better reading experience to my followers from eToro and to reach out to other people who might be interested in learning how to invest money. Subscribe to receive notifications for my posts.

Introduction

Let me start by introducing myself and telling you the story of my early exposure to stock markets.

I grew up in India and live in Germany. I am a Computer Engineer by profession. More on my professional accomplishments some other day, but I want to mention that I have also worked in a prominent High Frequency Trading company because that is relevant to the topic.

I had early exposure to stock trading, but it wasn’t very inspiring. I saw my father lose a lot of money and mind in trying to predict the short term movements of the market. My father is a polymath with degrees in Engineering, Law and Business and has had an illustrious career. Stock trading was the only thing he ever failed at.

I have always been deeply analytical and I question everything until I can understand it in detail. I understood that owning a stock meant owning a piece of a business which had a certain value based on the amount of profit it was making and the growth it could achieve in the future. But I did not understand why the price of the stock, and the company by extension would fluctuate every second by such large margins. When nothing changed about the company, why did its stock price fall and rise so rapidly all the time.

I deduced that these movements were caused by trading of stocks among retail traders. But how did the traders make their decisions to buy and sell? I was told that there were patterns in the numbers, what went up must come down and vice-a-versa. But why did it go up or down in the first place? I didn’t get a clear answer. I also saw that most people who were trading stocks were losing money. Even as a high school kid, I was able to quickly conclude that since there was no new actual information being released every minute on which to base their decision, these day traders were simply gambling.

Wouldn’t it be easier to simply review how a company was doing and invest in it for the long term? This should be fairly easy to do for someone with basic arithmetic skills and basic knowledge about how to evaluate business performance. Why did my father with all of his knowledge didn’t think of that? Why did he or anyone fall for this trap and lose money in day trading? The real answer to this question only came to me much later in life. Many people turn to gambling or buying lottery tickets, when they realize that their income is insufficient to fulfill their dreams. They are looking for a shortcut to wealth. This is what tempts them to take risks.

There are no shortcuts to success.

My father is a proud man, and he had a hard time admitting to himself that he had failed. But eventually he demonstrated the strength of his character when he gave up on day trading and cut his losses. Not many are able to do this. The more money they lose, the more tempted they are to take more risks and this goes on and on.

Thank you for staying with me through this story, but the point I want to drive across is that day trading is nothing more than gambling. There may be nothing bad with gambling, but you should at least admit that you are gambling. The techniques to read charts are pseudo science. It is really easy to prove this by back testing. If there are any reliable patterns to make money from, they will cease to exist as soon as they are discovered because everyone would try to take advantage of those patterns, and day trading is a zero-sum game, everyone cannot win.

But long term investing is not a zero-sum game. Our economies are built on growth. We take loans because we are confident that we will be able to return the money along with interest in the future because our income will grow. If the income becomes stagnant or starts to drop, all hell would break lose. So the simple way to make money is to participate in the growth of the economy.

The start

Fast forward, by the year 2017 I had reached a point in my life when I was earning more than I could spend and I was starting a family so I started looking for investment opportunities. I did not have enough money to buy real estate yet, so stocks were the most attractive option, but I was not looking for any shortcuts. I started reading books and discovered dollar cost averaging.

Dollar Cost Averaging is the investment approach where you invest a fixed amount of money at regular intervals, spread across a group of promising assets.

The key idea is that it is impossible to time the market. So by investing a fixed amount of money regularly in the same assets, you are reducing the risk of bad timing. You are still exposed to the risk of bad asset choice though. To avoid that risk, you can invest in ETFs instead of individual stocks.

If you don’t want to invest any time in managing your investments and don’t want any headache, just do this and you don’t even need to read further. That’s exactly what I started in 2017 while I continued reading and learning more about investment.

The Foundation

By the year 2019, even before I bought my first individual stock, I had at least a basic investment strategy in place.

I realized that you don’t need a sophisticated strategy to make money, in fact the simpler the strategy the better because the key to success is in the execution of the strategy. To be able to execute a strategy, it is important to remain objective and not let emotions control your decisions. Fortunately, I have had a privileged background and a healthy relationship with money. I have all I need, and I am satisfied with what I have. I do not feel emotional about money, and I am not tempted to take any shortcuts. These are natural areas of strength for me.

To further make sure that I stick to the plan, I formulated the following core principles that drove my decisions,

Do not try to time the market.

Have conviction in your ideas, but do not get over-confident.

Regularly manage risks.

Introspect.

Do not try to time the market.

Instead of investing a lump sum amount to start with, I will start investing with a small amount and will gradually invest more money periodically to my account. I will gradually build up individual positions and continue buying when the stock dips.

Have conviction in your ideas, but do not get over-confident.

It is really easy to objectively valuate companies. On top of that I will add (or subtract) subjective valuation that I derive from my understanding of the business and its growth potential.

Only after I’ve thoroughly researched a stock, should I invest in it. I document my analysis as it will prove handy when the stock doesn’t move in the direction that I anticipate, as they often do. In times like this, I will review this thesis to gain confidence to be patient and wait for my prediction to come true.

Regardless of how much I believe in a stock though, I must always remember that my subjective analysis may be wrong. So while it is important to have conviction and take risks, it is important to not get over-confident. I will limit exposure to each stock and I will regularly rebalance my portfolio to limit the risks.

Regularly manage risks.

Risk management is a continuous process. Diversifying investments is a good start to limit risk exposure to a single asset. But over time, your allocations go out of balance. Some positions may outperform and grow beyond their original allocation, and would need to be trimmed by securing profits. Some positions may suddenly become more volatile, and would also need to be trimmed to reduce the overall volatility of the portfolio.

Introspect.

Some people are scared to close trades in a loss, they believe that you only make a loss when you close in a loss. That is a big fallacy. By doing this, investors accumulate poorly performing assets in their portfolio and give up on those assets that are outperforming the markets.

The role of an investor is not to get every trade decision right, but only a majority of decisions right. By definition, we are bound to make mistakes. And so instead of sinking good money after bad, it is important to introspect, accept mistakes and make amends.

The Test

With this knowledge, I started looking for an online broker. eToro caught my attention because they had zero transaction fees and supported fractional shares. This was important, because I want to invest in small increments and transaction fees would take a chunk each time.

With a small investment, I bought a few shares in companies I knew and understood well. I focussed on technology stocks, that I understood well and liked. I also bought $AAPL at around $50, and $NVDA at around $50 too. I also bought $TSLA at around $15 (split adjusted) which was the lowest price in past years. TSLA recovered quickly from this bottom in the second half of 2019 and early 2020.

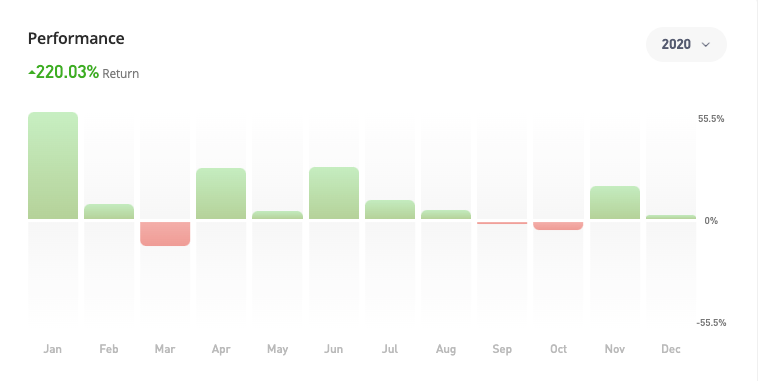

When COVID came in 2020, I added funds to my portfolio and bought the dip in even more tech stocks like $GOOG, $MSFT. Needless to say I had a spectacular year and closed 2020 with over 200% gains.

I had also started writing informative posts on eToro and starting getting my first copiers and followers. I applied to the Popular Investor program and quickly rose to the Champion Level.

Even though I had a great year, I was acutely aware that this wasn’t a proof an exceptional year and it won’t be easy to reproduce this success every year. I mentioned this upfront in this Youtube video I made to introduce myself to my copiers. I also explained this same strategy in this early video too.

Sure enough 2021 wasn’t going to be so kind. Nonetheless, I continued executing my strategy rigourously and consistently beat the NSDQ100 and SPX500 indices.

Around mid of 2021 however, I got the opportunity to work as a Software Engineer for IMC which is a prominent Market Maker or a High Frequency Trading firm. To take this job, I had to quit eToro because I was no longer allowed to trade privately. I bid good-bye to my 280 copiers, closed all my trades and turned my account private.

My job required me to travel every month to Amsterdam and I was supposed to move to Amsterdam by the end of 2022. My wife had given birth to our second daughter, so traveling and moving became challenging. Fortunately, I also found another attractive job offer, so I decided to leave IMC after a short stint of 1 year. But that meant, I could return to eToro.

I started from scratch with 0 copiers in August of 2022. This was a tough time to enter the market, but sticking to my strategy I started with a small amount and continued to buy the dip. I ended the year with 10% loss, but my strategy started bearing fruit very quickly when the market started recovering rapidly in early 2023.

My performance combined with the reach of my educational posts, helped me regain copiers. In the last 18 months, I have managed to organically grow my copiers to more than 800 and AUC to more than $1.6M. Here is a new introduction video I created where I explained my strategy in a little more detail.

As you can see from these videos, I have stuck to the common sense strategy that I have described here and the results should speak for themselves.

This post is longer than I expected, but should serve as a good introduction as well as being educational for the reader. I will continue to share posts in the near future where I will explain my investment approach in further detail. Be sure to follow me and subscribe to my newsletter.

I will quickly conclude by reminding you that stock investment is not rocket science. The key to success is not in a complicated strategy, but in being able to rigorously execute a simple strategy.