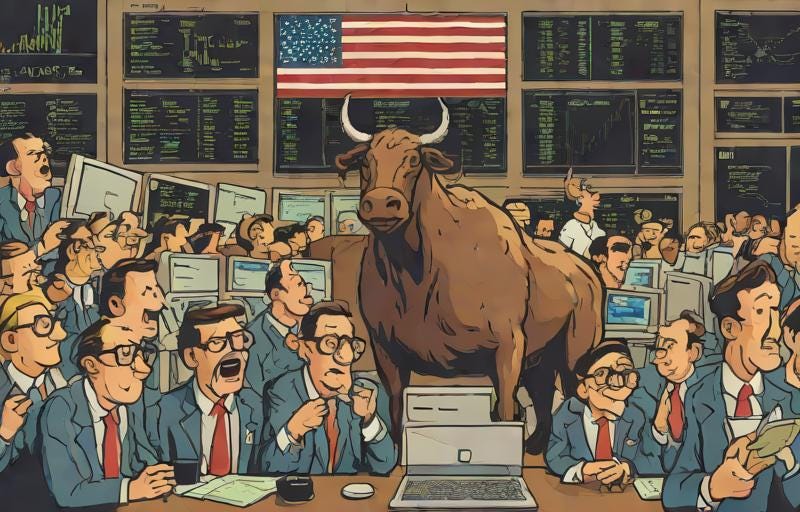

Market loves high interest rates?!

The US Federal Reserve Bank (or Fed) announced today that it will not cut interest rates until it has confidence that the inflation rate is moving towards the targeted 2%. In the recent data, inflation remained high at 3.1%.

Normally a policy like this make borrowing expensive, should reduce spending, should reduce profits and lead to job losses. That doesn't sound good, but instead the market loves this news. What started as a red day has quickly turned into green. If this confuses you, I recommend you read this article where I explain why higher interest rates push stock prices up.

As I've explained in the post linked above, I expect the bull run to continue until the interest rates start to drop. The previous indication from the Fed was that interest rates should start to drop in May 2024, but that was considered too soon by the market. I expect the expectation now is that interest rates will stay up for Q2 and may start dropping in the middle of Q3.

The anxiety is high and short sellers can't wait for the market to crash, but the fact is that there is no other avenues for the money to flow towards.

I urge you to control your anxiety and stay invested. Copiers don't need to worry about securing profits. I've already taken a defensive stance and secured profits from my tech positions in NVDA 0.00%↑ AMD 0.00%↑ QCOM 0.00%↑ TSM 0.00%↑ and INTC 0.00%↑ and continue to reduce exposure to volatile tech stocks, but I will continue to stay invested in the market. The only way to beat the market is to stay in the market, and buy the dip.

Short sellers have already incurred huge losses which they won't be able to recover from. But by securing profits timely and maintaining liquidity, we will be able to buy the dip and recover faster than the market.